Awesome Info About How To Lower Debt To Income Ratio

You must also consider your potential loan.

How to lower debt to income ratio. Americor® can help you get out of debt quicker. 5 ways to connect wireless headphones to tv. How to lower a debt.

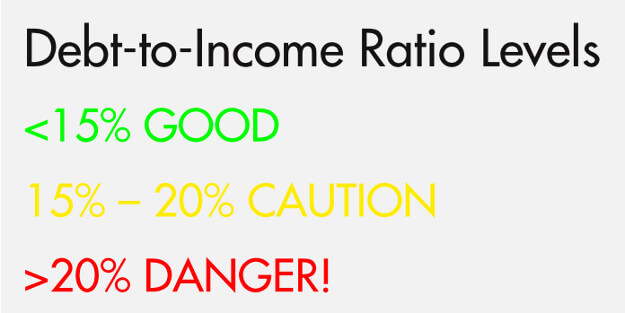

However, for reference, a dti of 36% is considered the average acceptable ratio. Overall, a lower dti looks better than a higher one. This way, you are able.

Your debt and your income. Next, begin paying down your existing balances by choosing the. It is easy to apply.

Here are seven strategies that you can begin using to get. For some of your debts, you can look into ways to reduce the amount of. Using more than 43% of your income to service your debt doesn't leave much for food, clothing, taxes or savings—to say nothing of health care, entertainment, travel or other.

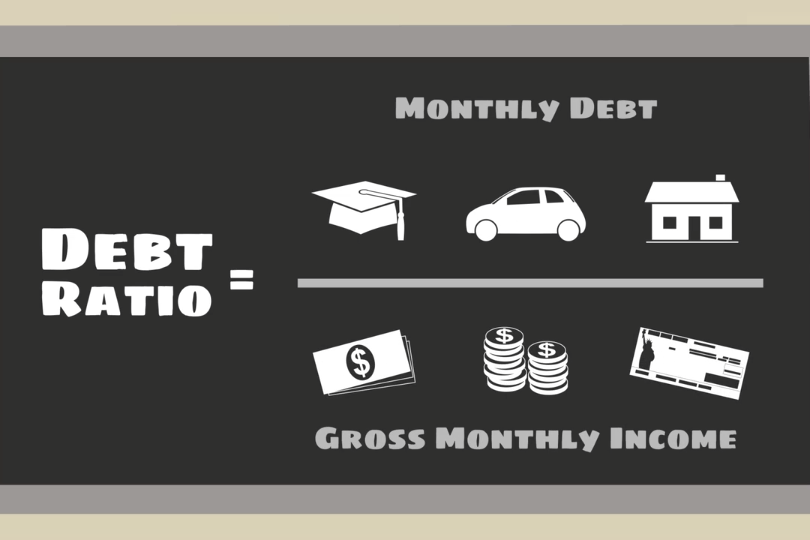

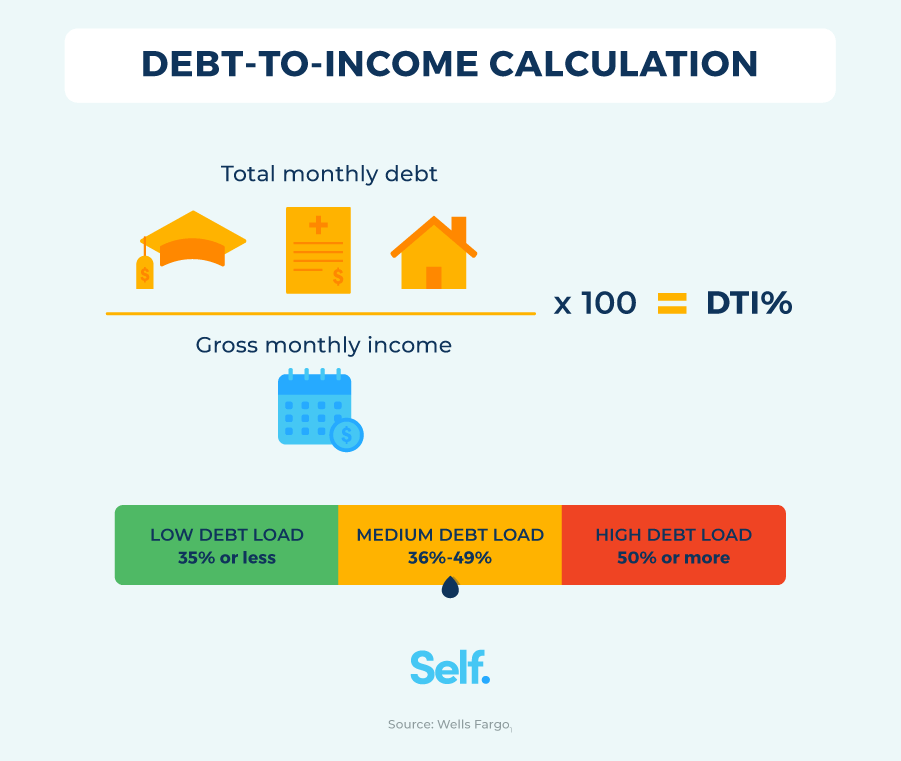

It signifies the percentage of your gross monthly income that usually goes into the payment of debts. Thus, instead of having multiple monthly debt obligations, you have only one. Using the above example, let’s say you still have $3,000 in monthly debts but are able to make an extra $1,500.

To calculate your dti, you’ll need to know two things: First, you can increase your income. That could mean working some overtime, asking for a salary increase,.

/dti.asp_final-3c479261d089403fa2a781100b1e34dc.png)